A Beginner’s Guide to Creating a Financial Calendar

Happy New Year QUBER community! Whatever you celebrated, we hope your holidays were amazing. But, now that they’re over, we’re laser-focused on the year ahead of us. Do you have a vision of what you want to achieve with your money this year?

We know the nature of the holidays make December a tough time to focus on your finances, and that’s OK. However, there’s truly no time like the first few weeks of January to create an ambitious new financial plan for the year ahead and start executing it. But, if you’re just getting actively involved in improving your financial health, you may not know where to pick up. Of course, as a beginner, two of the best steps you can take are to ensure you’re regularly tracking your expenses and following a budget. Those who budget are shown to be less likely to fall behind on their financial commitments, less likely to spend more than their monthly income and less likely to need to borrow money to cover their day-to-day expenses. You can learn more about how to create a budget by checking out A Beginner’s Guide to Budgeting.

However, by drafting a budget solely on a month-by-month basis, you might run into trouble. Every month of the year is going to bring events that make it financially different than the last, meaning each month can’t stand alone as a financial period; you’ll need to rely on your income from the beginning of the year (and often the year prior) to cover expenses that will arise later in the year. For example, in March, you may find you’ve got some extra income to spend, so you go ahead and make a few purchases. But, then comes April, and a family member has an important birthday you forgot to consider. You’ve got to attend a birthday dinner, and you feel obligated to get them a present. You had some extra cash in the budget in March, but you now may have to borrow money to cover the costs of this birthday only a few weeks later. This is a simple example, but illustrates that with personal finance, it’s critical to assess more than one timeline to manage your money effectively. A monthly budget will help you guide your financial decisions on a week-by-week, micro-level, but an annual plan will help highlight the macro-level issues that a monthly budget cannot. Ultimately, having a 12-month plan will give you a clear idea of what you can afford in 2021 without the help of credit, and thus will help you reach your financial goals with ease this year.

With that in mind, we wanted to use this first Money Talks article of 2021 to offer a guide on how to plan out your financial commitments for the year ahead. This process is going to be highly personalized; we can’t give you the specifics of your calendar, because everyone has vastly different financial responsibilities. However, we’ve compiled a few major categories of expenses that apply to most Canadians, which should help you plot out a pretty accurate description of what 2021 is going to cost you. Once you have this info, you’ll be able to make smart financial decisions as you move through the year and feel confident that you’ve got yourself financially covered.

Getting Started

Before you get started, you’ll need a 2021 calendar. This could be on paper, in an agenda or planner, or any kind of digital/online calendar; whatever you prefer is fine, as long as it’s an accurate calendar for the entire year of 2021 that you can mark up. Beyond that, if you already know you’re going to need some reference materials, gather them before getting started. By reference materials, we mean anything that would include mention of a specific payment schedule or date that you need to note. This could be bill payments, important tax dates, a list of kids events and so on. Also, be sure you have a clear figure for your total annual, after-tax income based on what you’re currently earning. If you earn income on a variable basis, do your best to estimate what you’ll earn overall in 2021 by using your current income and what you earned in 2020 as a guide.

As we go through the various categories of expense you might face this year, you’ll need to mark down the amount you’ll owe on its specific due date each month. If you don’t have a specific date in mind yet but know you’ll be on the hook for something, make a note of it at the top of that month’s calendar. You can revisit it and assign a date closer to the event. If you know a date but don’t know a specific amount you’ll owe, try to come up with a ballpark, realistic budget and mark it down. You can reassess at a later time, but it’s important that as many of your calendar entries as possible have a dollar figure associated with them to make your overall calendar as accurate as possible.

Even if you don’t have any dependants or complicated line items to consider, this process will take some time to complete accurately. But, we encourage you to stick with it even in the event it becomes a bit tedious for you. A completed calendar is an incredibly useful tool to have as you progress through the year and will make managing your expenses on a month-by-month basis much easier than if you don’t have one.

1. Holidays and Birthdays

There are a number of different holidays that’ll create costs for you, and it just makes sense to plan ahead for them - you know they’re coming at the same time as they always have, so there’s no excuses for being unprepared! Of course, the largest of this group is the winter holidays we just experienced, including Hanukkah, Christmas, Kwanzaa, New Years and more. It was estimated in 2019 that the average Canadian household spends $1706 on gifts, travel, entertaining and more during Christmas. If you’re not ready to take on those costs when December comes, you might be forced to spend January stressed about how to pay off your holiday credit card balance. Instead, if you plan ahead and start saving for the winter holidays in the middle of the year or earlier, you’ll have a nice amount of liquid cash to help cover the cost of gifts (and hopefully parties!) for 2021.

Beyond the winter holidays, there are a number of other holidays you should consider. For example, are you a huge Halloween fan? Or, do you have young kids who love Halloween? If so, buying costumes, candy, decorations and more will add up. A similar logic applies if you celebrate Easter and have to purchase treats for an egg hunt, decorations, food for a large dinner and so on. Consider the costs of Thanksgiving, Valentine’s Day, summer long weekends and more, and if you think it’ll affect you in any way financially, mark it down.

Then, beyond holidays, there inevitably a few important birthdays for each of us to note. For most people, this would be our immediate family members and perhaps some close friends. If you know you need to purchase a gift or you’ll be celebrating them in some way, treat those dates like holidays in your calendar. There’s no need to be spending hundreds on presents for the people in your life, but planning ahead might allow you to buy the most amazing present for a loved one without relying on credit to do so.

2. Rent, Food, Transit, Clothing

Holidays and birthdays are fun, but only first on our list because they’re easy to mark down. It makes sense to next turn your attention to your essential expenses. These are generally the major line items of your life, and are financial commitments you must meet. If you fail to do so, you and any dependents you have might face serious consequences like eviction, losing your job or hunger as a result. First, consider your annual shelter costs. Whether you rent or own your own place, jot down what you’ll owe in rent or mortgage payments each month this year. Consider homeowner’s insurance in this payment schedule as well. Include the cost of your utilities, Internet and your phone bill. If you find any of your bills are variable each month, come up with a reasonable figure that’s on the higher side so an unexpectedly high bill won’t set you back too far.

Next, include a ballpark figure for how much you would usually expect to spend on food for your household each month. It’s important to have this figure be as realistic as possible, though there’s no need to get too specific – just a ballpark round number, like $250 or $600. Again, it helps to estimate a bit on the higher side here so that you don’t run into trouble as the year progresses. Include this figure at the top of each month. Also, if you’re a pet owner, add the costs of your pet’s food and treats in this figure as well.

You’ll also need to note your expenses for transit over the coming year. If you own a car, jot down figures like your monthly payment, gas costs, insurance, planned car service and so on. If you don’t own a car but rely on public transit, include your monthly costs for service. If you’re taking rideshares like Ubers frequently, come up with a ballpark figure that represents what you’re spending on average each month (but, only do so if rideshares are essential for you to get to work or other important commitments). Finally, add what clothing you need to purchase this year, but only what’s truly essential. This may be a bit tough to calculate, but just include an estimate based on what you expect to have to replace from your current wardrobe. For example, if you need to replace a winter coat because your last one is no longer wearable, you must buy a winter coat. In Canada, that’s essential to your safety and survival, and thus an essential expense. But, if you’re buying a winter coat for some variation from your current jacket, that’s not essential, and shouldn’t be considered in this category.

3. Loans/Debt

This is an extension of essential expenses, though still distinctly separate. Failing to repay high-interest debt as fast as you can afford to is one of the easiest ways to tank your financial situation, and may create serious financial consequences for you. So, if you currently owe creditors money, your minimum payment schedule needs to be clearly marked in your calendar, starting ASAP. Of course, you should be aiming to pay more than this amount back each month if at all possible, but you should have a clear figure you need to cover at minimum each month to stay on track you can mark down. This applies to both loans, like student loans, and other forms of debt, like credit card debt.

Create a repayment schedule that’s fair to you but also focused on the end goal so you have a clear end date in sight to work towards. Having a defined end date to your debt payments will help keep you motivated as you chip away on your total. If you feel you’ve got an overwhelming amount of debt you need to pay down, you should be devoting an above-average amount of your disposable income towards paying it down until it’s small or nonexistent. Though it’s no fun, you really need to cut down on anything that can be eliminated from your budget for a bit while you focus on your debt. Just remember it won’t last forever, but your debt will if you don’t take action!

4. Health Care

We’re fortunate in Canada to have the cost of many health services covered by our government, but there are still plenty of essential services and products not available for free. To be clear, there’s no real way you can plan ahead for a bill that arises from an accidental injury or illness besides diligent saving (that’s where having an emergency fund comes into play). But, there are a definitely a few health-related expenses that you should know to see coming each year, and given their cost and importance, you should be planning ahead to cover them without credit.

Again, this is highly personal, so it’s tough to suggest everything a person might need over the course of a year. But, if you plan on seeing a dentist, an optometrist, need to replace your glasses, have kids getting braces, plan on having some form of elective surgery or otherwise this year, be sure to mark down those costs. Unsure of what those may be? A call to your doctor’s office or a quick search online may give you a reliable figure to use as you plan the year.

As an extension of this idea, you should also consider the veterinary costs you may incur over the course of 2021 if you’re a pet owner. Again, you can’t really predict if your pet will need emergency care, but they’ll inevitably need their annual physical and perhaps some vaccinations. Depending on their age, they may need a spay/neuter surgery over the coming year or they may have regular prescriptions they’ll be taking for the foreseeable future. These are the types of costs you can plan for, and should be marked as such in your calendar.

5. Tax Season

This may end up being an interesting year for tax collection for many people due to the financial and economic effects of COVID-19 on our country. But, you can be sure the Government of Canada won’t be putting a total freeze on tax collection. The deadline to file and pay your 2020 taxes as an individual in Canada is April 30, 2021. If you’re self-employed or have a married/common-law partner who is, you can file until June 15, 2021, but would still need to pay your taxes by April 30.

Consider any money you’ll need to pay in order to file your taxes on time. Do you need access to tax software? Are you going to hire an accountant or bookkeeper? Particularly if you collected CERB payments in 2020, consider how your tax responsibilities might have changed this year. You may have entered a higher income bracket, meaning you’ll be taxed at a higher rate. It’s also always smart to have a bit of liquid cash put aside around this time of the year, just in case you don’t receive a return but instead owe money back to the government.

6. Saving and Contributions

As we’ve highlighted many times before, you need to save before you consider all your non-essential expenses! If you wait until the end of your pay period to save whatever you have left over, chances are you often have nothing left to save. Instead, determine a minimum amount of money to save each month based on what you expect you’ll be earning. This could be a set amount if you’re a salaried employee, or it could be a percentage if you earn a variable amount of income. It might be reverse-engineered from a total amount you want to save by the end of 2021. Mark down this amount on your payday, or the day after at the latest to be sure it’s accounted for right away.

By contributions, we mean to the kind of accounts that allow you to grow your wealth tax-free – this includes TFSA’s, RRSP’s, RESP’s and more. Making these contributions are optional, but are something that every adult Canadian should be doing. These kinds of accounts will help you save your money without being taxed on it, helping you get ahead as you grow your savings for major goals like your retirement or a child’s education. Each kind of account has an annual contribution maximum, meaning every Canadian can only save into each specific account up to a certain dollar amount each calendar year. Those limits are as follows for 2021:

Tax-free Savings Account (TSFA): $6000, but if you’ve never contributed to a TFSA before their introduction in 2009, your maximum cumulative contribution limit for 2021 is $75,500

Registered Retirement Savings Plan (RRSP): $27,830

Registered Education Savings Plan (RESP): $2500

Particularly if your employer offers a contribution-matching plan that will match part of what you save in 2021, you need to be saving into your registered savings accounts over the course of the year if you can afford to.

Money Talks will have more on all these types of funds coming soon. Stay tuned!

7. Household Expenses

This category of items includes toiletry items (shampoo, toothpaste, face wash and so on), cleaning supplies, kitchen supplies and cookware, stationary, storage containers and supplies and so on. These items aren’t explicitly essential to your survival, but are necessary to live a reasonably comfortable lifestyle and maintain a clean household. As there’s a spectrum between want and true need here that’ll be different for every household, you’ll need to take some time to consider what your household’s minimum requirements are. While it’s somewhat straightforward to guess how much you spend on toiletries each month, the other types of items aren’t often month-by-month repeat purchases. Instead, it might be easier to come up with one ballpark budget for all your household items in total per month and include it at the top of your calendar each month.

Don’t forget to consider household services as well. If you rely on a housekeeper, or landscaping services such as lawn service or snow removal, don’t forget to include those in this category. Consider your potential needs for other services like plumbing and HVAC, and that some of your major appliances, like your washer/dryer or your fridge, may need servicing to maintain them. This is a bit tricky, as in general, people often call for service when they notice something is broken and need a quick fix; as such, these expenses could easily be considered more of an emergency fund expense than a planned event. However, if you know ahead of time you’ll need a professional to offer you service or repair somewhere in your home, note that down in your calendar wherever applicable.

8. Kids Expenses

If you’ve got children, we don’t need to tell you there’s going to be a major list of expenses for them specifically over the coming year. This could be anything kids participate in or need, from sports, camps, daycare or babysitting, after-school activities, school fees and supplies, toys and games and more. Remember to consider the entire list of items you’ll need to make these types of events and/or activities work. For example, if your child wants to start playing hockey this year, you’re going to be on the hook for skates, pads, a stick, pucks, a net at home, team/league fees, a team uniform, a helmet and a mouthguard. You might need to cover the costs of attending a tournament, snacks for the team and coffee for while they practice. You may also need to consider gas costs, depending on how far you’re driving to their practices and/or games. This one activity alone would present hundreds of dollars in accumulated costs, which means you’ll likely need to be saving for them months before the season actually begins.

9. Major Events

Finally, do you have something big planned for 2021? It could be a family vacation, a home renovation, a major appliance replacement or a new car purchase. This could be anything that would create a major, one-time expense for you that will be unique to this year but is not emergency-related. For example, an emergency home repair due to unplanned damage is something an emergency fund should cover, whereas a kitchen facelift done by choice is completely voluntary.

Include these figures in your calendar where they would be according to your plan, but save it as the last major thing you’ll add to your calendar. Highlighting the cost of such events around all the other essential expenses of your planned year will show you whether or not you can really afford your big ticket item in 2021 or not. If you’re finding that it won’t fit amongst all the other expenses of your calendar, you can either eliminate other non-essential expenses to offset the costs, or you may realize you need to put it off entirely to avoid financially over-committing this year. By planning the year ahead with this event in mind, you can avoid the possibility of making a major mistake by overspending on a big expense before it’s too late to reverse it.

Analysis + Example

Once you’ve gone through the above list of categories and filled out your calendar, you’ll be able to start examining this year’s financial shape from a more holistic perspective. Though our list of categories is exhaustive, it not might include everything you might have to cover, so be sure you’ve got everything that’s going to have a financial impact on you in 2021. Viewing your month-to-month cash flow, you’ll be able to see clearly how much you need to cover the year’s coming expenses. You should also be able to compare your total, estimated after-tax income for 2021 with the amount you’ve got marked down for expenses and the amount you’ll be saving over the year. If your expenses greatly outnumber your income, you know already now that you’ll need to make changes to your calendar if you don’t want to take on a major amount of debt.

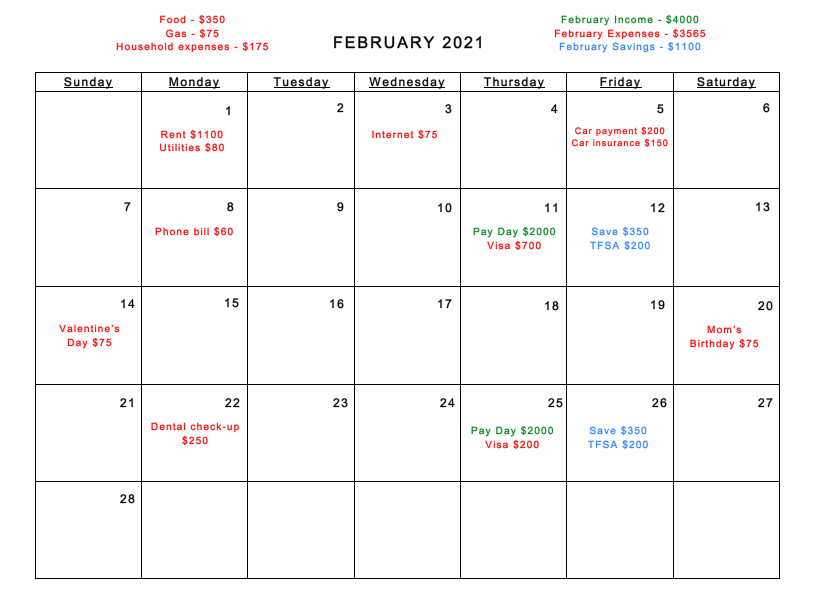

Below is a very simple example of what one month in your calendar might look like - we used February 2021. We’ve used colour to differentiate between money coming in (green), money moving out (red) and money moving to another location to be saved (blue).

From the above example, you can see that when you subtract what this person intends to save in February from their monthly income, their monthly expenses actually equal more than what they’ve got left over. This month, this person has to cover the costs of an important birthday, a holiday, a dentist appointment and is trying to pay down their Visa bill, and can’t afford to do it all with what they’ll earn. But, because this person created an annual calendar, they have the information they need to prepare for those extra costs in February without having to borrow money to make it work. There are a variety of ways this person could do so, including saving more of their disposable income in January to carry it over to February, pushing expenses forward if it can be done (ex. rescheduling the dentist appointment for sometime in March or later) or reducing the amount of money they intend to contribute to their TFSA or put towards their Visa balance. Any of these choices will allow this person the flexibility to use liquid cash to cover their expenses instead of having to put their purchases on their credit card.

You might notice that non-essential purchases, like takeout, coffee and more aren’t mentioned anywhere on this calendar. That’s because most people can’t really plan out how much disposable income they want to spend each month - it’s ultimately what’s left over when you’ve covered the essentials, which may be little to nothing. Assuming that you can give yourself some set amount for your non-essentials is misleading, because sometimes you simply don’t have any income left over once you’ve covered your essential bases, but if you indulge yourself anyways, you inevitably have to use credit to do so. This type of decision-making is often how people end up with a large amount of high-interest debt, which is a major contributor to financial insecurity. Of course, you should still occasionally reward yourself if you’re doing well with sticking to your financial plan. It’ll help you stay on track in the long-run, and you do fairly deserve to enjoy the things you like with the money you earn sometimes. But, if you’re constantly indulging your every want on a whim, it’s going to be nearly impossible to minimize your reliance on borrowed money.

Ultimately, we hope this guide helps you create a solid financial plan for the year ahead. Again, this exercise will take you some time to complete, but it absolutely, 100% worth the effort it requires. Happy 2021!

Check back to Money Talks every Monday for a new post featuring more tips and tricks on how to reach your saving goals, and subscribe to our mailing list for blog updates!

Have a suggestion for something you’d like us to write about? Shoot us a message at contactus@quber.ca and we’ll get to work.