Our Final Thoughts on 2020

2020: it’s been an intense year, and the world we live in has gone through some major changes. At QUBER, we’ve spent quite a bit of time focused on how the events of this year have influenced the way Canadians manage their money, and it’s been interesting to see the types of financial patterns that have emerged as a result of the pandemic. For example, prior to COVID-19, the average Canadian household was saving 2-3% of their disposable income; during the second quarter of 2020, that figure jumped to 28.2%. While we absolutely welcome this increase in saving, ultimately, we know that rise is rooted largely in concern and uncertainty. 2020 was, financially, a very tough year for many Canadians. Over 3 million Canadians lost their jobs suddenly in March and April, and though the majority of this group has since returned to work in some form, the fluctuating nature of lockdown measures has forced many to deplete their savings and/or take on high-interest debt to cover their expenses this year. That’s one of the reasons we feel that employer benefits that focus on employees’ short-term financial needs are so important in our country right now, and something that Canada’s major employers should be taking note of as they help their employees navigate 2021.

Millions of Canadians are looking towards the new year with hopeful, though maybe cautious, optimism that things won’t be as financially straining in 2021 as they were over the past 12 months. However, it’s also important to note that if you had a financially challenging 2020 and you want to see some positive change this year, global events like the pandemic aren’t the only piece of the puzzle you need to consider. If you’ve been neglecting to save part of what you earn, spending lots on non-essentials, failing to budget and more, you put yourself at a severe disadvantage when it comes to facing major, unexpected events, like the pandemic. But, we’re here to remind you that changing your financial habits is not only possible, but really not as hard as it may seem and is absolutely worth the effort. As such, we wanted to share some of the results of our recent December User Survey. We asked our users a few questions on what kind of financial topics they know more about, what they’re saving for in the new year and more, and we think the results may inspire you to tackle your finances head-on in 2021.

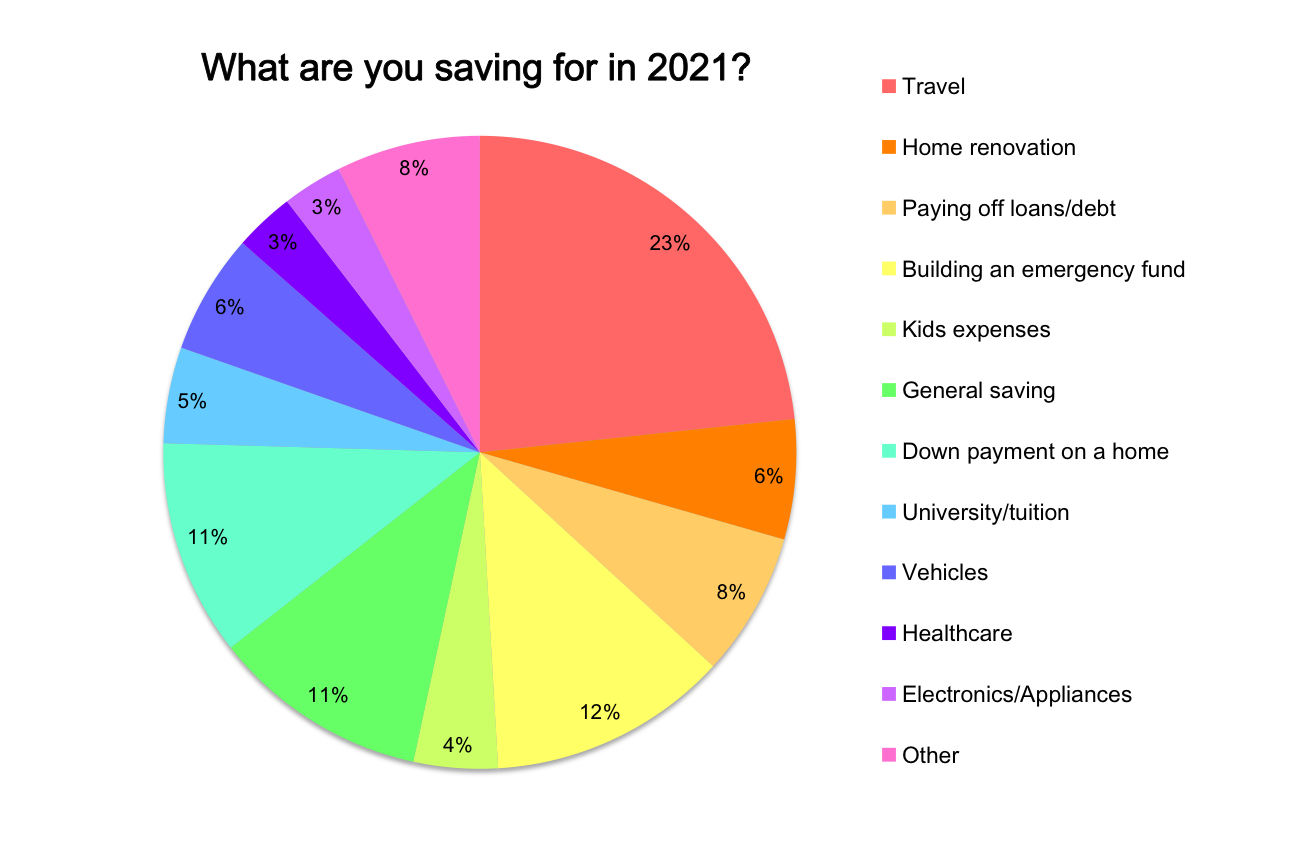

What are you saving for in 2021?

It seems that travel is on everyone’s minds after being cooped up all year! The largest single thing you guys are saving for right now seems to be travel, with 23% of reporting that you’re saving for a trip in 2021. Some of you mentioned destinations like Colombia, Mexico, Jamaica, and Las Vegas, while others were keen to take a trip within Canada or simply go camping. There are also a great deal of you (12%) focusing on building an emergency fund, which we love to see. We were also excited to see that some of you are working towards some major financial milestones in 2021, like saving for a down payment on a home (11%) and paying off the costs of post-secondary education (5%).

Whatever you’re saving for in 2021, don’t forget to actively use it to motivate you as we progress through the year. Picturing that end result of achieving your goal can be a very powerful motivator when it comes to reaching your goals. Ultimately, we’re just happy to see that you guys are focused on saving this year, and hope that QUBER will be an active part of that process!

Do you have a financial New Year’s resolution? If so, what is it?

This question was a two-parter, as 25.5% of you reported that you don’t have a financial resolution at all. If you voted “no”, or you would have voted “no” if you took the survey, we’d encourage you to think again. There must be some way you can improve your financial habits, your personal finance routine or your level of financial literacy for 2021 - even personal finance pros can always stand to learn more, or finesse their strategies to improve their results in some way!

For the 74.5% that did have a financial resolution, we also asked what that resolution is. We were happy to see that 38% of you mentioned you’re going to be trying to save more in 2021, with spending less being the second-most mentioned resolution at 18%. While 16% of you mentioned debt in general terms, another 9% of you specifically mentioned paying off credit card debt as your top financial goal for the new year. Overall, we were happy to see that the majority of you are thinking about how you can improve your habits in 2021, and we’ll be there to support you along the way!

What kind of financial products/services do you want to know more about?

This was of particular importance for us, as we want to know what our users are most interested in learning about as we plan for the coming year. The results were clear; more than 1 in 4 (26%) of you want to know more about how to safely start investing, with TFSA’s coming in second place at 20% of the vote and RRSP’s coming in third with 17%. What this says to us is that there are a large number of our users interested in learning more about how to make their money work for them, and how to grow their wealth safely and effectively - and we’re listening! Saving is a critical first step towards reaching any financial goal, but we also want to provide you guys with information on all these kinds of products and services so you can take the next steps with the savings you’ve grown with QUBER.

Stay tuned in 2021 for Money Talks coverage on all these topics. We’ll have some guest articles from our friends at Willful (they specialize in low-cost online will creation) and PolicyMe (they aggregate life insurance policies to help you find the cheapest option) going over their areas of focus soon into the new year.

What do you find to be the toughest type of purchase to avoid when you're feeling impulsive?

This one is interesting for sure, as it seems clear where you guys are seeing your disposable income leak out of your bank accounts! Takeout food (35%) and online shopping (38%) were the two clear winners when it came to impulsive spending. Other types of purchases ranked, but didn’t come anywhere close to these two categories.

So, if you find that you have a tough time avoiding these types of purchases yourself, it might help to know you’re far from alone. To be fair, it is important to acknowledge that your local restaurants need your support right now. If you can afford it, occasionally ordering in takeout from your favourite local spots is helping to keep them alive, and thus shouldn’t be hastily eliminated from your budget entirely. Still, if you find you’re going overboard, the internet is full of a wealth of tips you can find from others like you who have struggled with mindlessly spending on these items but succeeded in cutting back. If you’re looking to get started on changing your behaviour, check out Online Shopping: Resisting the Urge, Eating Well on a Budget or Taking Control of your Vices.

On a scale from 1 to 5, how much of an impact has QUBER had on the way you managed your money in 2020? 1 means QUBER had no impact at all on your finances, whereas 5 means QUBER was the most important/effective resource you used to manage your money.

While there were still 14% (2% reporting 1, 12% reporting 2) of you that didn’t rank QUBER as being very important in your overall financial management routine, the vast majority of you gave us a pretty high ranking. This made us really happy to hear - thank you all! QUBER exists because we love helping people grow their savings and turn their financial situation into something they don’t have to stress about on a constant basis. We also love hearing personal stories of how QUBER has made an impact in their lives of our users, and really appreciate all the support and word of mouth referrals we get from you guys. But, psst - if you’ve been spreading the word about QUBER to your friends and family, don’t forget that you could be earning cash incentives or extra Save to Win ballots for it.

If you ranked us a 1 or a 2 (or you would have if you’d taken the survey), we’re interested in why and want to know what we could be doing to make your answer change to a 4 or a 5 in 2021. If you’ve got suggestions for us, please feel free to let us know!

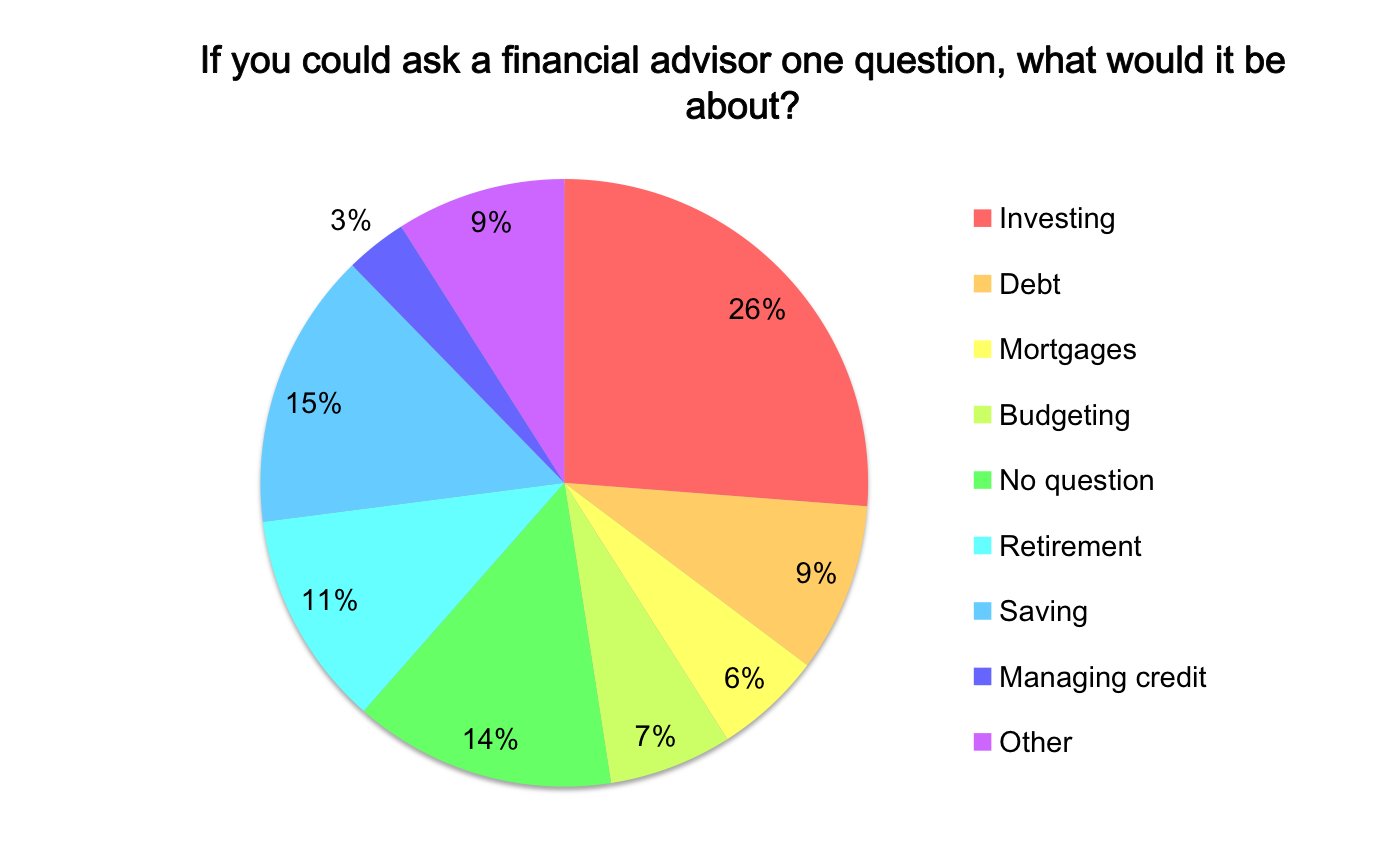

If you could ask a financial advisor one question, what would it be?

Finally, on our survey, we asked our respondents to provide a specific question, but for the purposes of the graph, we aggregated those questions into general topics. This question also made it clear that a lot of you guys are ready to start investing, but don’t really know where to start. Many of you asked for the “best single piece of investing advice” an advisor could offer, or what the best investment one could make with a spare $50 per month is. 11% also had questions about how to tell if you’re on track to retire comfortably, and another 15% were interested in how to maximize your savings.

We were admittedly surprised to see that 14% of you didn’t have any questions for a financial advisor. Unless you answered “nothing” because you already have a financial advisor and have asked everything you need to, we hope you re-consider! If you’re an adult in charge of your own finances, it’s important that you know how to save, spend, use, grow and invest (and so on) your wealth in the most effective manner. In the same way you wouldn’t attempt to provide yourself with dental work to try and skip on the cost of seeing a professional, you should consider seeking professional financial advice to be an important element of your financial management strategy. If you do have a question you’d love to ask an advisor but are worried about the cost of doing so, you’ll have the opportunity to do so if you tune into our live $5000 Save to Win prize giveaway on our Facebook page at 11:30AM EST on January 8, 2021. Check out our Save to Win page for more details!

Our Final Thoughts

2020 was tough. This year shook things up in so many ways, and had harsh effects on the way we live, interact with each other and our government, operate businesses and even perceive the future. Despite the fact that we’re headed into the new year and vaccines are rolling out around the world, we’re not out of the woods just yet. The “normal” we return to when the pandemic has settled probably won’t look the same as it did in 2019, and the financial fallout of 2020 is bound to continue for many Canadians into 2021. Still, while you can’t directly control the effects of global events like COVID-19 on your life, you can take control of one thing; that is, your level of financial literacy. If you feel you’re suffering due to factors beyond your control and practicing poor financial habits, you’re simply putting yourself at a greater disadvantage. Really, you have nothing to lose and everything to gain by taking steps towards improving your financial routine - there is no downside to having a high level of financial literacy. With that in mind, we’re looking forward to helping more Canadians make a proactive step towards changing their financial habits and growing their savings in 2021.

Looking towards the new year, remember to stay safe, think of others, shop local, and save money! And finally, show your gratitude to essential workers wherever you can. Teachers, nurses, doctors, grocery store workers, and more - thank you so much! Your contributions towards keeping our country safe during this past year have been unparalleled, and we appreciate you every day. Happy New Year! ✨

Check back to Money Talks every Monday for a new post featuring more tips and tricks on how to reach your saving goals, and subscribe to our mailing list for blog updates!

Have a suggestion for something you’d like us to write about? Shoot us a message at contactus@quber.ca and we’ll get to work.