A Beginner’s Guide to Budgeting

If you’re trying to revamp the way you manage your personal finances, the obvious first step to many is to make a budget. However, once you actually get down to it, creating a realistic, effective budget is actually a lot harder than it sounds. That’s because in order to draft one, you need to have a strong understanding of the various components of your personal financial situation; how much you’re earning, how much you must spend each month on essentials, what you’re spending on “extras” and so on. If you’re just starting to improve your financial habits, you may not have a handle on all this info already. In this case, it’s understandable to feel that maintaining a formal budget may not be in the cards for you.

However, the ability to create an effective budget is a really important skill, and is essential if you want to be using your money as effectively as possible. According to the Government of Canada, 49% of Canadians report keeping a budget to help themselves keep their finances in check. It’s proven that those who budget are less likely to fall behind on financial commitments, more likely to demonstrate effective cash flow management and less likely to need to borrow money to cover day-to-day expenses. Though there are a number of online budgeting tools and apps available these days, it’s important that you learn what goes into the budget before turning to them for assistance. These kind of technological options are tools, but not total remedies; if you don’t know how to catch mistakes within them or to alter an ineffective strategy, you aren’t going to be likely to stick with using them on a long-term basis.

With that in mind, we wanted to offer our readers a step-by-step guide on how to create a budget. This is a simple example, but covers the basics the average adult will need to include in theirs. For the purposes of our example, we’ll assume we’re making a monthly budget; however, you can make a budget for any period of time, and may find you prefer budgeting for a shorter range as a beginner (ex. a bi-weekly pay period).

1. Determine Your Goal

The first step to creating an effective budget is to think about your ultimate goal - why are you making this budget in the first place? The answer will be different for everyone: some people want to reduce non-essential spending, while others want to stay on track as they save for a large financial goal. The reason why you want to take a new approach to money management will help you make decisions as you allocate your income, and will serve as a great reminder to stay on track when things get challenging.

2. Track Your Expenses

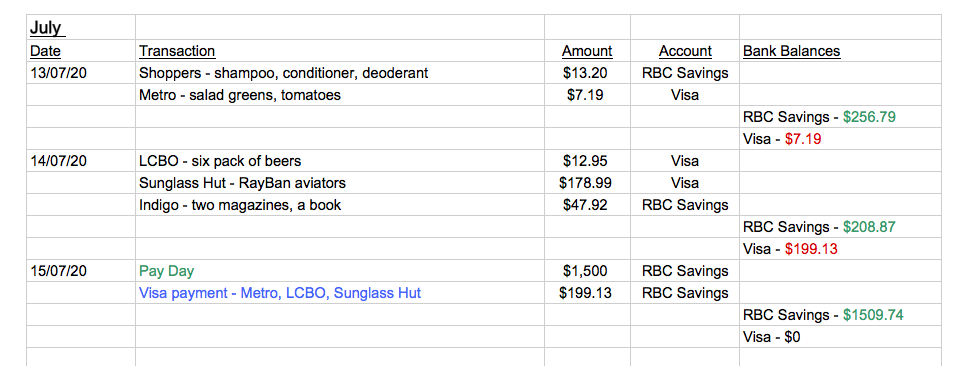

You can’t make a budget and expect to stick to it unless you create it with your lifestyle in mind. It’s also not feasible to assume you can keep track of all your spending in your mind alone, particularly if you have multiple bank accounts. As such, you need to be tracking your expenses in order to be able to create a budget. Make it a daily or almost-daily habit to be keeping records of everything you’ve spent money on, the account it’s coming out of, if you’re taking in any income and so on. If you use cash to make purchases, remember to keep your receipts so you don’t forget to include them. You can use a simple spreadsheet to do so, and you don’t have to make it overly complicated. The point here is to gain a clear understanding of where your various bank and credit card balances sit each day so that you can make educated choices with your spending from that point on. If you’ve never gone through this exercise before, you could create a spreadsheet that looks like this:

Once you have some data to look back on, you’ll be able to see clearly where your money is going. You can use this information to guide you as you create the structure of your budget, making changes where you see necessary.

3. Set Out Your Income

You’ll then need to determine with as much accuracy as possible how much money you’re taking in each month. For salaried employees, this is, of course, easier to do than for people who work multiple jobs or hourly positions where schedules change each week. If you’re unsure about what your income will be each pay period, go back over the past few months and come up with a reasonable average for what you expect to earn for the month you’re budgeting for. This number should include any income you earn from your job, as well as income from any other type of side hustle, planned sale of your belongings or anything else along those lines. This number is the amount of dollars you have to allocate to the various requirements of your life, and is the starting point of your budget.

4. Map Out Your Expenses

The next figures you need to nail down are your financial responsibilities. First, and most importantly, you need to determine your essential monthly spending. In other words, you need to know the total value of all your essential purchases each month, as this number represents the minimum level of income you need to earn to support yourself. This number is made up of your costs for shelter, food, utilities and transportation, but doesn’t include any extras. If you’re covering the essential costs of any dependants, like children or senior family members, their costs must be included in this figure as well. Ultimately, if you don’t make these payments each month, you’ll put yourself at risk of serious consequences, like losing your job (if you have no way to make the commute), having your utilities shut off or being evicted from your home. Arguably, if you have a pet, you could consider their costs as in this category as well, as if you can’t cover their needs, they may face being repossessed by animal services, disease or death.

Some of the components that will make up this total figure are going to be fixed costs, meaning the amount won’t change on a month-to-month basis (for example, your monthly rent). Others will be variable, and will fluctuate dependant on how much of a good or service you use over the course of a month. An example of a variable cost is your food costs, or your hydro bill. If you’ve got a number of variable costs to account for, use the same strategy from above for those who are unsure about how much income they’ll take in; go over your past few months of statements and come up with a reliable average you can use for each essential expense in your budget each month. It’s smart to round up to slightly higher than it may be instead of low-balling the amount and finding yourself in trouble later on.

In addition to these amounts, you’ll need to consider any insurance and/or any loan repayments you’re on the hook for at the moment. Though these don’t fall directly into the “essentials” category, they are often directly linked to your essentials, and it should go without saying that without covering these costs, you’ll face some serious consequences (ex. without paying your car insurance, you can’t legally be using your car). Your monthly payments for these types of items should be placed at the same priority as your essentials, though it’s important to recognize these amounts as separate.

5. Consider Your Savings

Next, you’ll need to account for the amount you’re going to save that month. You must consider saving right after you’ve paid for your essential bills. If you wait until you’ve covered everything else you want to cover that month, you’ll probably find you have nothing left! Instead, select an amount you want to save off each paycheck that aligns with your original goal from step 1; this could be a set amount each month, or it could be variable. It’s important to save some money from each paycheck you receive, but someone saving for a down payment on a home is likely going to need to save more of their income than someone who’s trying to reduce their spending on non-essential purchases would. You should also be thinking about having numerous different pools of savings, such as having a dedicated emergency fund separate from your other savings. So, determine what you need to save according to the rest of your goals, and make sure you have a secondary bank account to store them in so they stay saved. If you don’t have a dedicated savings account started already, you can store your savings in the QUBER Vault for free. If you’re interested in getting started, you can download the app by clicking here.

6. Think About Seasonal Spending

When creating a budget, it’s important to remember that each month is different. As such, you’ll need to consider the date before you draft your budget for the month. There are a ton of different events each year that require you to spend more than you normally would during an average week. These include holidays (particularly Christmas), birthdays of immediate family members or close friends, annual health-related costs (for you, and for your pets if you have them), planned car servicing, kids events and so on. Assuming you’re creating a budget on a month-by-month basis, be sure to look over a calendar before you get to allocating your income to different categories. You may find you need to create “mini-budgets” for these events – the upcoming holiday season, for example, is always a multi-faceted chain of expenses that may require you to create a budget for the season overall.

7. Prioritize Non-essential Spending

Next, chances are, you’ve got a ton of other expenses that aren’t “essentials” but that you cover every month without fail. While these items likely bring you a great deal of comfort or create benefits for you, you won’t face serious consequences if you don’t cover their costs as you would with your essentials. These types of purchases could be anything, from Netflix to spending on toiletries or your gym membership. The tricky part here is that many of these items live in a sort-of grey area, meaning they do actually serve an important function, but you don’t absolutely need to be spending on them each month. A great example of this is clothing: clothing is an essential part of our daily lives, and a necessity to have for when you need to interact with the outside world. However, while we only really need a minimal level of clothing to serve that purpose, anyone who’s interested in style or premium quality clothing is spending way more on their clothes than that minimal amount. The same goes for anyone who buys premium quality food, or who pours money into additions for their car.

As such, this is probably going to be the hardest step of creating your budget, as these are subjective choices instead of being clear-cut figures like your essentials or your income. If you’ve been tracking your expenses for a while, you’ll have data to refer back on to see where your money has been going over the past few months. You’ll need to assign each of your regular expenses a priority in terms of which will be allocated for first after the essentials, saving and seasonal costs have been covered. By engaging in this exercise, you’ll know exactly which types of purchases you need to cut down on (or cut out entirely) if you’re having a tight month. For example, you may find that you don’t earn enough income to cover every non-essential you want, but value going out for dinner with friends once a week more than you value having a daily coffee on your way to work. After considering your priorities, it’s clear which purchase of the two needs to be minimized or eliminated entirely. This exercise can also highlight expenses that may be worth ditching altogether. For example, if you’re living on a budget, you probably don’t need to be paying for both Netflix and cable TV; given the cost difference between the two, opting to keep Netflix and ditching your cable subscription may help you meet your budgetary requirements elsewhere.

8. Decide Which Approach to Take

For your last step before you put all your information together, you’ll need to decide what perspective you’re going to take on allocating your limited resources. There are a few different kinds of budget, and you can determine which kind makes sense for you based on your initial goal/s from step 1.

Two of the most popular kinds of budgets today are the zero-sum budget, popularized by financial advisor Dave Ramsey, and the 50-30-20 rule, developed in part by Sen. Elizabeth Warren. The former, the zero-sum budget, approaches budgeting from the perspective that every dollar of your income should be accounted for when dividing it into categories. So, if you make $4000 each month, you should have “a job” determined for every one of those $4000; this job could be paying rent, to move into your savings or to be used when you go out with friends. This type of budgeting is a more rigid style of allocating your resources, so can be tougher to follow for those who struggle with impulsiveness when it comes to their money.

The latter, the 50-30-20 method, offers budgeters a simple rule to follow. That is, 50% of your income should go towards essentials, such as rent, food and clothing, 30% of your income should go towards non-essentials like subscription services and eating out and 20% of your income should go towards saving. This method gives you a clear figure of how to split each paycheck you receive, and will allow you to take a more flexible approach to how you spend. It also may highlight that you’re living outside your means when it comes to your essentials (are you spending more than 50% of what you earn just to stay afloat?). However, depending on your goal, you may find this style of budgeting leaves you too much wiggle room. For example, if you’re focusing on reducing non-essential spending, you might find that you allow yourself too much leeway in where that 30% is going, and you might find it too easy to fall off track.

9. Allocate Your Income

Once you’ve gathered all the information from the above steps, you can start to allocate where your income is going to go. First, you’ll need to ensure you cover the costs of your essential expenses before considering anything else. Be sure to factor in set dates, like your pay schedule and due dates (ex. most people pay rent on the 1st of each month). The easiest way to ensure this gets done properly each month is to automate as much of it as possible. By that, we mean you should be setting up automated bill payments with your utility providers, your landlord, your insurance providers and more. If it’s automated, you’ll never forget a due date and incur late fees along the way.

Once you’ve covered your essentials, it’s time to account for the total amount you’re going to save for the month and move it out of your primary bank account if you have it already. This is another area where automation is extremely helpful; if you have a system in place that will move your savings out of your bank account automatically, you don’t even need to think about getting it done. QUBER can assist with automating your savings, as you can choose from a variety of different ways to save and have it automatically transferred out of your primary bank account to the QUBER Vault.

Then, you’ll need to add in any seasonal spending you might have to account for. Once you’ve taken this dollar amount off your remaining total, you’ve got the amount you have left for your non-essentials. This is the pool that all your non-essentials will come out of, and should make it clear why it helps to prioritize them before you make it to this stage. Once you see how much of your income you have left to cover these non-essentials, you can start filling in your priorities from highest to lowest. Are you able to cover all your non-essentials without relying on your credit card to fill a major gap? The point of living within a budget is to find out how you can most effectively live within your means. If you’re involving your credit card in the mix in any significant way, you need to go back to the drawing board and change how you’ve allocated your income. Alternatively, you could consider a large-scale change to one of your essential purchases. These aren’t generally “quick fixes”, as finding a new place to live or selling your car aren’t generally quick processes, but saving a large amount of money on one of your essentials could afford you a ton of flexibility when it comes to covering the other costs in your life. If that sounds like something that would make managing your finances significantly easier, then don’t forget to consider these larger changes as an option too!

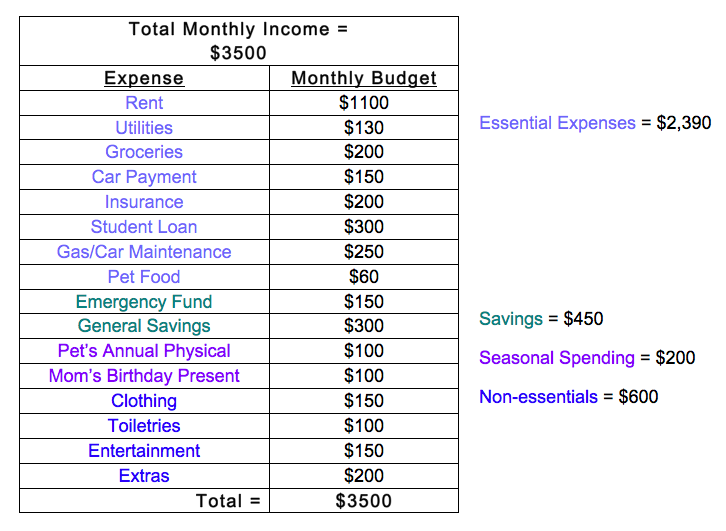

Once you’ve got everything set out, you should have a clear structure to follow as you spend over the next month. Your budget can follow any pattern you’d like it to, but here is a rough example of what to expect:

10. Get to Work!

Now that you’ve created your budget, it’s time to put it into practice! As you go about your daily life, you need to get into the habit of stopping to think before every purchase, “does this fall in line with my budget?”. Some purchases will be clearly allotted for, like your weekly groceries, while for others, like the various costs associated with attending social events with friends, you may have to do some math to determine if they’ll throw you off track. As you’re tracking your expenses each day, you can now keep a running tally to see where you’re at with your spending as the month goes on. Are you on in line with the targets you’ve set out for yourself, or are you spending way faster than you should be for this point in the month?

11. Track Your Results

Even with your best intentions in mind, your first couple budgets will probably need some tweaking along the way. That’s because if you’re not yet in the habit of sticking to a budget, you may not realize you’ve misallocated your income until you’re putting it into practice. As such, you’ll need to track your results with your budget as you go. Any day you spend money, you should be updating your budget/expenses tracker and calculating your new totals to see if you’re staying in line. If you’re not, what could you be doing differently? Don’t look at this exercise as if it’s a pass/fail on budgeting overall; if you’ve overspent based on the budget you’ve created, you can use that to learn some valuable lessons about the intersection between your lifestyle and your income. You may find that you’re simply not allocating your money in a way that makes sense for you. For example, you may be saving a ton of money, but then find yourself using your credit card to cover the cost of groceries at the end of each month; saving less might seem counterintuitive, but if you’re borrowing money to cover essentials, it’s going to even out to about the same amount of money saved over time (or even less, if you end up getting charged interest fees on your credit card). However, if you’re finding you repetitively can’t stick within your budget, you have clear evidence that you need to make some lifestyle changes. This could be due to overspending on non-essentials, or it could be a sign that you need to reduce costs on your essential purchases (as mentioned above). Ultimately, engaging in the habit of tracking your results will give you all the data you need to make more informed choices, and will serve as great information to offer a financial advisor if you’re interested in getting professional financial advice in the future.

We hope these steps will help guide you as you create your first budget. Remember the give yourself a fair amount of slack as you adopt your new habit; it can be hard to stick to a structured budget in the beginning if you’ve been completely free with how you spend your money up until now. However, the financial stability and peace of mind you can gain from managing your money mindfully is absolutely worth the time and effort.

Check back to Money Talks every Monday for a new post featuring more tips and tricks on how to reach your saving goals, and subscribe to our mailing list for blog updates!

Have a suggestion for something you’d like us to write about? Shoot us a message at contactus@quber.ca and we’ll get to work.