Wellness, fueled by saving.

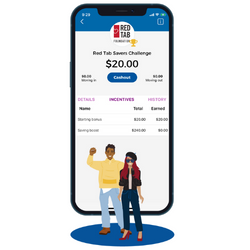

Help your employees save money for unplanned (and planned) expenses, and become mindful of their spending with QUBER, an innovative and inclusive financial wellness benefit.

We help you improve the financial health of your employees

Incentivized saving

Your employees develop the habit of saving money as they earn matched incentives.

Our app is easy to use, highly engaging and lots of fun!

Financial education

In addition to behaviour-changing nudges and relevant personal finance content, employees can learn about other benefits available to them through your organization.

Reduced stress

As your employees grow their savings, improve their financial habits and increase their financial literacy, they’ll minimize the negative impact of financial stress in their lives (and on your organization).

OUR VALUES

We care deeply about reducing financial stress for your workers and giving them the tools to make confident decisions with their money.

FLEXIBILITY

We offer a fully customizable program that can adapt to meet the specific needs of your organization’s diverse workforce.

ONBOARDING

We’ll work with you to reach unprecedented onboarding rates for your emergency savings benefit plan. ”Levi’s achieved their biggest cohort ever, in the history of the program, with QUBER.”

BEHAVIOUR-CHANGING PLATFORM

Your employees will save 5x more with QUBER after six months than they would saving with automatic payroll deduction.

RETENTION

After one year of saving with QUBER, 80% of employees continue to save and participate in their employer’s benefit program.

EMPLOYEE SUPPORT

Our 5-star App Store rating says it all. Your employees come first, and will be treated with respect and compassion by our team.

After one year, 87% of Levi’s employees said they would have never saved as much money if it hadn’t been for QUBER.

“Not only are Levi’s employees thrilled to have an extra liquid savings account that is helped by our matching, but the habits and behaviour change really stick for a long time.”

- Jenny Calvert Rodriguez

Executive Director, Red Tab Foundation

Some of our featured partners and clients:

QUBER leverages behavioural science to help employees focus on growing their savings and make long-term, tangible improvements to their financial habits.

Your employees will thank you for:

• A no-fee emergency savings account

• Access to your organization’s exclusive customized group

saving plan and matched incentives

• In-app education on a variety of personal finance topics and

other employee benefits available to them

• Personalized and contextual nudges to help keep them on track

• Chances to win cash prizes