QUBER Hacks: Using the App to Your Best Advantage

As a QUBER user, you may have wondered at some point, how do I use the app as effectively as possible? QUBER was designed to encourage people to save using the same behavioural science that marketers use to get people to spend money - we want our users to grow their savings, not fritter them away! Even a beginner-level user can reap some major rewards as they use QUBER, but as we’re pretty well-versed in all the features of the app, we figured it might be helpful to share some simple tips and lesser-known info that’ll help you get the most out of your QUBER account.

1. Note your deposit schedule

We use an electronic funds transfer (or EFT) system to move money to and from The Vault. EFT’s are computerized transfers from one bank account to another, and are not the same as Interac e-transfers. This is important to keep in mind, as money movement with QUBER isn’t instant. When you have a transfer to The Vault scheduled, money is actually withdrawn from your account within 1-2 business days from the date that transfer is started.

As such, it really helps to leave yourself reminders of upcoming transfers and consider when you can expect them to leave your bank account. This is particularly true if you’re a new user! For example, if you set up a bi-weekly Saving Rule that withdraws $100 from your bank account every other Friday, that money won’t actually leave your bank account until the following Monday or Tuesday. If you have an agenda or calendar, jot down your transfer dates and you’ll always have a reminder before the transfer is in motion.

As an added note, though we receive your deposits and store them safely as soon as they leave your bank account, they won’t actually reflect in your QUBER account until the fifth business day after the initial transfer date. This is because it can take up to 5 business days for error notifications such as non-sufficient funds (NSF) errors to get back to us on deposits. Once that time period is over, your deposit will reconcile fully and show up in your account.

2. Plan ahead with Challenges

As an extension of the point above, we recommend taking a minute to look at a calendar before starting any Saving Challenge. When you first start a Challenge, you have the choice to pick your start date. This is the date that will determine the rest of your Challenge’s schedule over the next year and once you’ve started saving, you won’t be able to change it on your own. Based on factors like your pay schedule or a preference for a specific day of the week, you may find that you want to set your start to a specific day to create the ideal schedule going forward.

3. Start simple with your Saving Rules

Saving Jars were designed to be super flexible, and give users the chance to save on their own schedule. When you create your own Saving Jar, you’re given full control over how you’d like save, how often, how frequently and so on by setting Saving Rules. One of the most important things to remember with Saving Jars is that you’ll need to accumulate a minimum of $10 in a Jar before a transfer to The Vault is actually started. Everything saved below that amount will remain in a pending state until $10 is reached, when it’ll all transfer to The Vault together.

As such, if you’re a new user, we’d recommend starting simple with your Saving Rules. Transaction-based spend Rules, like rounding up on purchases and taxing yourself at a certain merchant, are going to trigger a series of transfers with irregular amounts, like $0.45 or $0.32 at a time, making it harder to predict when you’re going to hit $10 total and have a transfer start moving. You’ll still get a notification from the app when the transfer starts, but if you’re worried about how that might affect you, we’d instead recommend calendar-based Rules to start - they’re 100% predictable! Once you’re a bit more used to using the app and anticipating upcoming withdrawals, adding in transaction-based Rules will be much easier to handle.

4. Compounding interest v. QUBER Saving Challenge

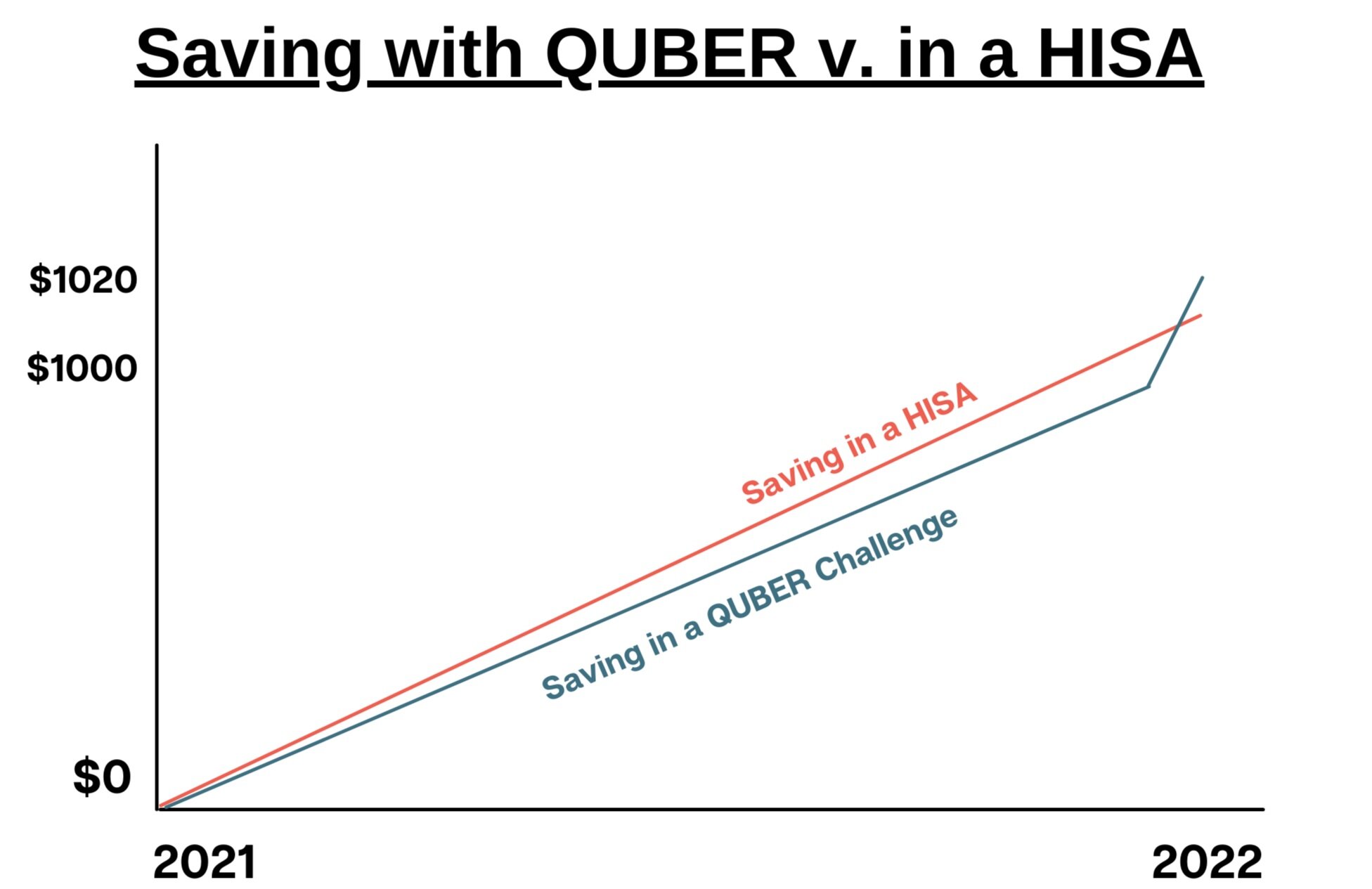

As a QUBER user, it’s possible that you’ve wondered before if you should focus on saving into a high-interest savings account instead of into your QUBER account. We offer 2% interest on every QUBER Saving Challenge you successfully complete, but even if your savings account is offering a lower interest rate, it’s likely generating compound interest for you. How do these two options stack up over time?

There are a ton of different variables at play here, but for the purpose of our example, we’ll keep it simple and assume you’re starting from $0 and trying to save $1000. You could do so two ways: you could save it in your HISA as you earn income over the year, or you could save it with QUBER through a 1K Saving Challenge. We’ll assume that you’d be saving at the same frequency with both options, meaning you’d be making monthly transfers of $91 and not cashing out at any point during the year so you truly hit $1000 at the end. With QUBER, you’ll earn an incentive worth 2% when you complete the Challenge, but will not earn compound interest on your deposits throughout the year. With your HISA, you’ll be earning interest and it’ll be compounded monthly, but at a lower rate of 1.2%.

No fear on how to calculate compound interest - there are a ton of different free compound interest calculators available on the Internet that will factor in your contribution rate, your interest rate, your timeline and so on. We used one provided by the Ontario Securities Commission to find the results on the left below to compare to our 1K Challenge results on the right.

Calculating for both, it becomes clear that you’ll earn more interest saving $1000 with QUBER than you will opening a HISA and saving that money there. Though it outpaces the QUBER Challenge for most of the year, the interest rate in your HISA and the one-year timeframe isn’t high enough to create big enough gains to match the return offered by the Challenge. You may not receive compounded interest payments with QUBER, but because our interest rates are better than that of your HISA, you still stand to earn a return worth almost 300% more with a 1K Saving Challenge than you would be in your HISA under these conditions.

It should be noted that compound interest is calculated by multiplying your initial contribution to the account, otherwise known as the principal amount, by 1 x the annual interest rate raised to the number of compounding periods minus one. Simply put, what that means is that if you’ve got a high amount of savings and you can afford to leave it untouched for a long time, the amount you can earn in interest will likely outpace the 2% we offer. Still, even if this applies to you, think about using QUBER Challenges to earn a 2% reward and then move that money in its entirety to your HISA where it can continue to accrue even more interest over time. In the same way that debt consolidation requires looking for the place in which your debt will be serviced at the lowest interest rate possible, think about how you can maximize your returns by strategically moving your money to where it’ll earn the highest interest rate possible at any given time. If you’ve always got a QUBER Saving Challenge going, you can annually move that money to your HISA and then let compounding do its thing.

5. Consider saving in multiples of $20

When you save at least $20 in The Vault, you automatically become entered into a Save to Win draw. Users earn ballots for the contest based on their overall Vault balance’s growth in multiples of $20. For the weekly prizes, that time period is one week long, and for each grand prize this year, the period is roughly 3 months long.

As you save in The Vault, we recommend saving in multiples of $20 if you can manage to do so comfortably. Ballot counts are always rounded down to the nearest $20 - for example, growing your Vault balance by $115 during a contest period would get you 5 ballots, not 6. There’s no issue with saving more or less, but if you’re saving in multiples of $20, you know you’re maximizing the number of ballots you could be earning by not missing out on small rounding issues that might otherwise bring your ballot count down.

6. Take advantage of our referral program

If you’ve ever told a friend about QUBER because you enjoy using the app, thank you! We really appreciate all the word of mouth we get from our users, as we know that the opinion of a trusted friend or family member can be critical in trying something new.

As a way to thank those who spread the word about us, we offer two different kinds of rewards through our referral program. You can choose to earn cash rewards if you Challenge a Friend to join our $150 Saving Challenge, or earn one extra draw ballot for the next upcoming Save to Win grand prize when you Refer a Friend and they create an account with us.

We know that we obviously benefit from you referring your friends, but seriously - taking advantage of the program is the easiest way to earn some extra money to put towards your goals! When your friend completes our $150 Challenge, you’ll both earn a $10 reward - that’s worth just over 6% interest, and for you, it’ll be on money you didn’t even save! After our point above on high interest rates being important to look for, this one is a no-brainer. Plus, who doesn’t want to win prizes? Earning extra Save to Win ballots by referring friends is easy, and might end up winning you a prize worth hundreds!

7. Use QUBER to help save into registered accounts

For those with numerous saving and investment accounts, it can be tough to decide where to save your money and earn the best return on it. The reality is, there’s no one-size-fits-all answer to share, but we do have a suggestion for you. If you’ve got a QUBER account, you can use it as a stepping stone towards saving in your registered accounts and increase the amount you move to them overall.

For those who have registered accounts, it’s more than understandable if you’re not hitting your contribution limit each year. With RRSP’s in particular, many people feel they need to commit to not seeing that money for a long, long time if they choose to save it there to avoid tax penalties, meaning they’re less likely to be devoting much to it. Still, even with more flexible accounts like TFSA’s, registered accounts are often the last stop on the list when it comes to distributing income for many people.

Instead, we’d suggest that you use QUBER to save towards your registered accounts as it’ll allow you some flexibility before “committing” to your RRSP or TFSA. If you participate in any of our QUBER Saving Challenges, you’ll save gradually over 52 weeks, which will allow you one year to determine if you really need that money for something else before committing it to a registered account. A financial emergency may come up later this year, and you’ll be able to use your savings within a few business days, penalty-free, if you saved them in your QUBER account. Once you’ve finished the Challenge and earned your 2% reward, you can then move the entire amount into your registered account of choice. That way, you can make a large deposit that doesn’t feel overwhelming, and that money can continue to grow tax-free for years to come!

8. Tell us how you feel!

Finally, your opinions about the app as a QUBER user are extremely important to us. Hearing honest feedback from users about what they love and what needs to be improved is essential to us as we expand our offerings, improve user experience and better the app for more Canadians to enjoy.

If you’ve been using QUBER for a while and you’re happy with your experience so far, we would love it if you could share with us by leaving a review on our page on the App Store or Google Play.

If there’s something you feel we could improve on, or you have suggestions for features you’d like to see within the app, we’d love to hear from you directly. Partial cashout, for example, was one of our most regularly requested features by our users, so we knew it was a high priority to get it launched. We want the app to serve our users as best it possibly can, so hearing from you really does have a tangible impact on the future of QUBER!

If you’re interested in joining thousands of other Canadians who are growing their savings and earning cash rewards for doing it, click here.

Check back to Money Talks every Monday for a new post featuring more tips on how to reach your saving goals, and subscribe to our mailing list for blog updates! Have a suggestion for something you’d like us to write about? Shoot us a message at contactus@quber.ca and we’ll get to work.